5 Payment Strategies to Enter Emerging Markets

Emerging markets are poised to significantly shape the global economy, contributing 65% of global economic growth by 2035.

Although cash remains prevalent, there is a strong shift toward digital wallets, mobile money, and real-time payments.

For businesses and platforms, emerging economies present substantial growth opportunities, yet they come with unique challenges. To operate efficiently and scale rapidly, it’s crucial to understand regional differences, customer behaviors, and infrastructure gaps.

Table of contents

What defines emerging markets?

Emerging markets are countries or regions experiencing economic expansion, industrialisation, and rising consumer demand. They sit between developing and developed economies, offering high growth potential but also greater volatility.

From a payments perspective, these markets combine two extremes: large populations still dependent on cash and traditional banking, alongside fast adoption of mobile phones, mobile wallets, and digital payments.

Key characteristics include:

- Large, unbanked, or underbanked populations are gaining first-time access to financial services.

- Urbanisation and demographic shifts are creating a young, digital-first consumer base.

- Governments are investing in infrastructure and real-time payment systems to drive inclusion.

- Businesses and consumers are demanding faster, cheaper, and more transparent financial services.

Which regions have the fastest economic growth?

Emerging economies are not a single market. They are a collection of diverse regions, each with its own payment behaviours, infrastructure, and growth trajectory.

Businesses must understand the regional differences when evaluating investment opportunities and designing payment strategies.

South and Southeast Asia

South and Southeast Asia are some of the fastest-growing regions in the world. India, Indonesia, Vietnam, and the Philippines are all recording rapid GDP growth, driven by young populations, urbanisation, and expanding digital infrastructure.

- India’s Unified Payments Interface (UPI) now processes more than 18 billion transactions per month, making it one of the most successful real-time payment systems globally.

- In Indonesia, the QRIS standard has unified QR payments across banks and mobile wallets, helping millions of consumers adopt cashless methods.

For businesses, this presents opportunities to scale through digital wallets and mobile payments. However, differences between countries in the Asia Pacific region mean that a payment method that works in Singapore may not succeed in Vietnam. Tailoring to local customer habits is essential.

Sub-Saharan and North Africa

Africa is home to some of the most innovative payment solutions. In Sub-Saharan Africa, mobile money services such as M-Pesa have provided financial access to millions who lack traditional banking services. Mobile payments dominate daily commerce, from remittances to retail transactions.

North Africa, by contrast, is seeing rapid growth in card-based payments and digital wallets as banking penetration improves. Governments across the continent are prioritising financial inclusion, and investment in payment infrastructure is accelerating.

With a young population and growing internet access, Africa’s digital payment market is expected to expand significantly over the next decade.

Latin America

While cash is still widely used, Latin America is shifting towards alternative payment methods. Brazil’s PIX, introduced by the central bank, has become one of the region’s most successful systems, allowing individuals and businesses to make instant transfers at no cost.

At the same time, digital wallets such as MercadoPago, Nubank, and RappiPay are changing online and mobile commerce. Consumers who can’t access traditional banking are using digital wallets for everyday spending, bill payments, and e-commerce.

The region offers significant growth potential but also complexity. Regulations differ by country, currencies fluctuate, and consumer preferences vary widely. This makes local expertise essential for building a payment strategy that works at both regional and country levels.

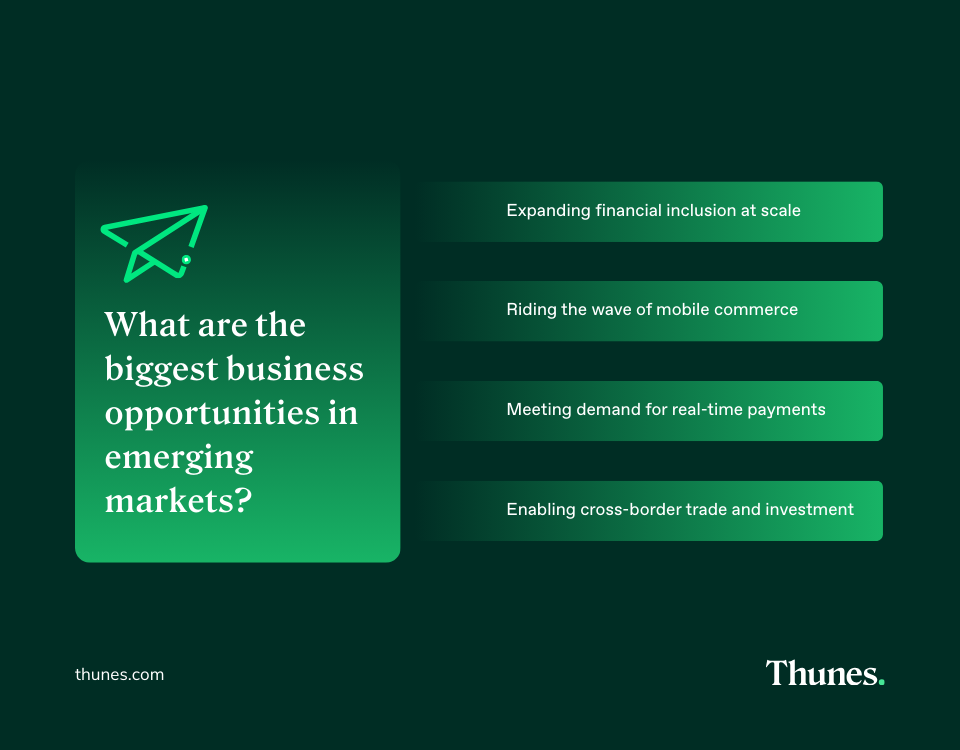

Key business opportunities in emerging markets

Emerging markets are bringing new opportunities for businesses and platforms.

Expanding financial inclusion at scale

Millions of people across emerging economies remain unbanked or underbanked. Mobile phones provide the entry point for financial services, from basic money transfers to savings and credit. Businesses and platforms that deliver low-cost, accessible solutions can benefit from this untapped demand.

Riding the wave of mobile commerce

E-commerce and mobile commerce are growing, fuelled by internet penetration and smartphone adoption. Payment providers that enable smooth, secure checkout experiences in local currencies can capture a significant share of this growth.

Meeting demand for real-time payments

Consumers and businesses in emerging markets are leapfrogging traditional banking systems. They expect near-instant transfers for everything from salaries to supplier payments. Real-time payments reduce friction, build trust, and accelerate the adoption of digital finance.

Enabling cross-border trade and investment

As global businesses expand into emerging economies, efficient cross-border payments are essential. Payment platforms that provide compliance, FX transparency, and settlement in multiple currencies will unlock significant opportunities in trade, investment, and commerce.

Five payment strategies to enter emerging markets

We’ve discussed why emerging markets are so significant, but how do you go about entering them? We’ve put together our top 5 strategies for any business or platform considering global expansion.

Survey your target market’s payment landscape

Customer payment habits are evolving fast, transitioning from traditional cash and card transactions to a growing list of alternative payment methods. It’s vital to understand the popular methods in your target market, including mobile wallets, QR codes, direct bank transfers/debit, prepaid cards, vouchers, Buy Now Pay Later and other options.

Success depends on smoothly integrating dominant local payment methods within the broader region and, crucially, in each specific country.

Assess and prioritise your payment needs

It is crucial to ensure the reliability and scalability of your payment solution. For example, if your target is the gig economy, technical scalability will be paramount for efficiently handling a high volume of payments, particularly at smaller ticket sizes.

There are several key priorities for businesses to consider.

- Interoperability with multiple payment rails and providers

- Scalability to handle high transaction volumes, especially in gig economy sectors

- Settlement speed to meet customer expectations for real-time payments

- Cost control to manage FX spreads, transaction fees, and compliance costs

- Customer support in local languages to build trust with new users

Addressing these needs from the outset enables smoother expansion and long-term resilience.

Survey the competition to crystallise your approach

Survey the competition and learn what payment methods they do and don’t integrate; you may find a competitive edge. In-depth local market research can yield significant benefits; merchants should thoroughly analyse their audience and collaborate closely with local PSPs.

Don’t neglect internal buy-in from your tech and product teams, as this will ensure timely project delivery.

Talk to local PSPs and partners

When entering a vast region like Latin America with its diverse payment landscape, local expertise is essential for overcoming language barriers and providing tailored advice. Ensure your local partner can navigate regulations and compliance in different markets, especially in the face of changing legislation. They must also have robust security measures and fraud prevention mechanisms for local payment methods.

Look beyond payment processing; for example, assess a partner’s ability to contribute to brand awareness and offer local marketing promotions. In some cases, a partner with strong ties to central banks can prove helpful.

Visualise what success looks like

Define your strategy from the outset. As a merchant, carefully assess the importance of going local and adopting domestic payment methods. Make sure that when considering cross-border payments and acceptance, you don’t exclude specific local payment methods and miss revenue opportunities.

If having a local presence is crucial, you can establish a local entity in the region or collaborate with a reputable partner.

How Thunes powers payments in emerging markets

Thunes provides the payment infrastructure businesses need to scale across emerging economies. Our Direct Global Network connects more than 3 billion mobile wallets and 4 billion bank accounts in 130+ countries, supporting a wide range of payment methods.

The key benefits of integrating with Thunes include:

- Access local payment options: Access to bank transfers, digital wallets, mobile money, and cash-out points.

- Scalable infrastructure: Designed to handle high transaction volumes across diverse regions.

- FX transparency: Real-time conversion with minimal spreads to reduce cost and risk.

- Regulatory compliance: Coverage across 50+ licences worldwide, easing the burden of navigating fragmented regulations.

- Local expertise: Partnerships with banks, PSPs, and regulators in Africa, Asia, Latin America, and the Middle East.

By combining global reach with local expertise, Thunes enables businesses to move money efficiently, securely, and at scale in emerging markets.

The future of payments

Emerging markets payments represent one of the strongest growth opportunities for global businesses. With rising GDP growth, adoption of mobile payments, and growing demand for real-time transfers, these economies are shaping the future of commerce.

Success requires the right strategies: understanding customer habits, building scalable infrastructure, securing trusted partners, and defining clear objectives.

By integrating with Thunes, the Smart Superhighway to move money around the world, businesses can overcome the challenges of fragmented markets and capture value in the world’s fastest-growing economies.

Contact us today, or watch our webinar here to learn more from the experts.