Mexico: Transforming digital payments in Latin America

Mexico’s payments landscape is transforming. As Latin America’s second-largest economy and one of its most interconnected trade hubs, Mexico holds a pivotal role in the region’s financial evolution. Its strategic position between North and South America, deep trade integration with the United States, and growing fintech ecosystem make it a natural anchor for payment innovation.

Through regulatory reform, innovation in payment rails, rising digital commerce, and experiments in stablecoin settlement, Mexico is laying the groundwork for next-generation payments and reaching a tipping point where infrastructure maturity, regulatory clarity, and cross-border demand converge. The nation is increasingly gearing up to plug into this evolution, routing cross-border flows directly into local rails. This article examines the key trends driving this shift.

Ecommerce and digital commerce acceleration

Ecommerce in Mexico is surging. The country is expected to lead global ecommerce growth in 2026, and is one of the few countries expected to exceed a 20% e-commerce share of total sales by 2029. On the payments side, digital adoption is rising. While credit and debit cards have traditionally held the largest share of ecommerce payments, wallet usage and real-time transfers are growing quickly.

Even though cash-to-digital voucher networks still play a bridging role, the trajectory is clear: consumers and merchants are migrating toward seamless, API-driven, instant checkout flows. For merchants, real-time payments ensure faster settlements, better working capital management and lower dependency on legacy processors.

Government initiatives as catalyst

In addition to market forces driven by ecommerce, Mexico’s government has taken a proactive role in framing its payments future.

The Financial Technology Institutions Law provides a legal framework for electronic payment institutions and virtual asset service providers, overseen by the National Banking and Securities Commission (CNBV) and the Bank of Mexico (Banxico). This has provided fintechs and payment platforms with confidence to operate within a more predictable regulatory environment.

A cornerstone of Mexico’s digital payments infrastructure is Sistema de Pagos Electrónicos Interbancarios (SPEI), Banxico’s 24/7 real-time interbank transfer system. Originally designed for institutional transactions, SPEI now supports millions of consumer and business payments each day, serving as the backbone for much of Mexico’s digital payments innovation.

One of the early retail payment experiments was Cobro Digital (CoDi), launched in 2019 to extend SPEI into everyday retail. Uptake was modest: CoDi has around 18.4 million validated accounts, but only a small fraction actively transact via the platform. CoDi’s limited growth is often attributed to friction, low merchant incentives and consumer hesitation.

Building on CoDi’s lessons, Banxico introduced Dinero Móvil (DiMo) a few years later, leveraging the SPEI network and linking telephone aliases to bank accounts and eliminating steps like QR scanning or manual entry of account numbers. Adoption has been promising, with millions of users onboarding and transacting, increasing integration with fintechs and banks.

In parallel, Mexico is advancing open finance mandates, pushing banks to share account and transaction data under standards that support competition and innovation. Policymakers have also been pursuing card payment reforms in 2025, focused on reducing acceptance costs, improving access for small merchants, and creating a more competitive payments landscape.

Together, these policies aim to reduce cash dependence, formalise commerce, expand inclusion and inject competition into payments. The challenge now is to translate infrastructure and regulation into real usage across all segments.

Rising adoption of real-time payments

Amid the transformations driven by ecommerce and government regulations, real-time digital payments are scaling rapidly. Over 71% of adults reportedly use SPEI for low-value transactions, reflecting their rising use in retail transactions, and this is a number which is expected to continue growing into 2026.

DiMo represents the next leap: alias-based transfers via phone number, eliminating many user frictions. As DiMo grows, it will increasingly drive peer-to-peer (P2P) and business-to-consumer (B2C) flows onto instant rails. In 2024, P2P transfers comprised 65 % of real-time payment flows in Mexico.

For merchants, fintechs, and PSPs alike, this infrastructure opens a new frontier of opportunity: faster liquidity, interoperable transfers and scalable connectivity across borders. As these systems mature, Mexico is set to become one of Latin America’s most interoperable and innovation-ready payments markets.

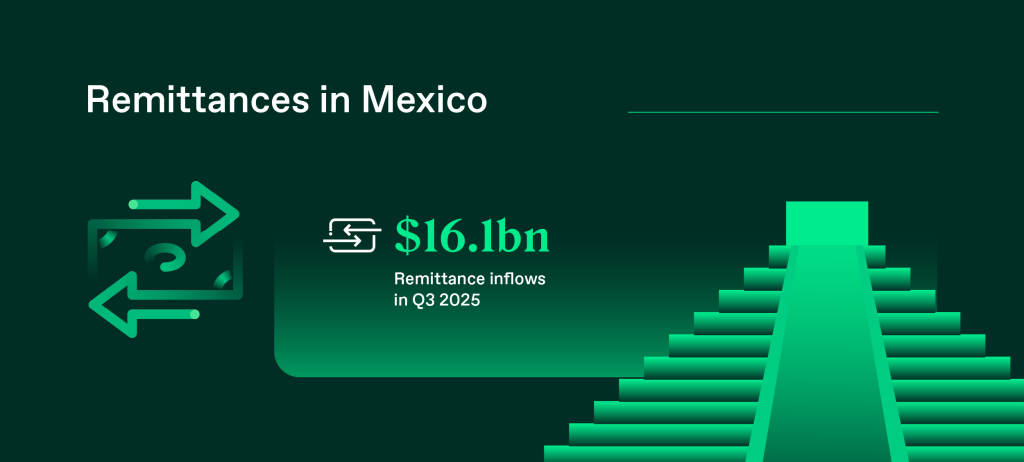

Remittances: A powerful driver of digital payments

One of the primary drivers of the digital payments boom is remittances, with Mexico receiving $16.1 billion in remittance inflows in Q3 2025 alone, largely from the US (97%), followed by Canada (2%).

The sheer scale and consistency of remittance flows make them a natural driver for payments modernisation. Licensed fintechs are increasingly integrating cross-border channels directly into SPEI and DiMo rails, enabling instant, lower-cost payouts. Stablecoin-based settlement models are also emerging: providers send value across international rails, convert into local currency onshore, and settle instantly via local real-time networks.

For Thunes and similar infrastructure platforms, this is a critical opportunity: to map global flows into Mexico’s real-time rails, improving settlement speed, cost efficiency, and transparency, and bypassing legacy correspondent bottlenecks.

Mobile wallets: inclusion enablers with growth runway

Mobile wallets are also carving out an expanded role in Mexico’s payments ecosystem, especially for underbanked users and everyday use cases. Adoption is rising, matching smartphone and connectivity penetration.

When mobile wallets integrate with alias-based systems (DiMo), users can transact instantaneously across institutions without needing to input bank details, reducing friction and expanding reach. For merchants, wallet acceptance reduces cash handling costs, improves traceability, and increases conversion flows.

As wallet adoption deepens, cross-border wallet interoperability becomes a forward-looking frontier, especially in border or remittance-heavy regions, where wallet-to-wallet transfers could complement formal rails.

Stablecoins: Layering in global liquidity

Stablecoins are increasingly relevant in Mexico’s payment infrastructure, offering 24/7 liquidity, rapid settlement, and reduced reliance on multiple banking intermediaries.

In cross-border and B2B transactions, fintechs are increasingly utilising stablecoin rails as settlement layers, particularly where capital efficiency and speed are crucial. They then convert to pesos and route funds via SPEI/DiMo for domestic payout.

Regulators have been cautious yet open: under the Fintech Law, virtual asset service providers must adhere to registration and transparency standards. Mexico’s authorities are closely watching global frameworks for fully reserved, compliant stablecoins and preparing guardrails accordingly.

It is important to understand that stablecoins are not rivals to SPEI or DiMo. Instead, they are complementary infrastructure connecting Mexico to global liquidity networks.

How Mexico is accelerating toward a digital payments future

Mexico’s payments landscape is constantly evolving. While cash still plays a crucial role today, the signs of transformation are unmistakable. A growing number of SPEI transactions, a rapidly expanding digital share in POS systems, strong ecommerce growth and the digitisation of remittances all point to an accelerating shift toward real-time, digital financial infrastructure.

Mexico’s journey involves layering new rails, refining retail overlays, and introducing global liquidity: a transformation that aligns closely with Thunes’ mission to move money around the world without friction. Through our Direct Global Network, connecting over 130 countries and 22 billion endpoints, Thunes empowers payment providers, fintechs, and financial institutions to expand their reach into Mexico. By linking directly to local rails, from bank accounts to mobile wallets, partners can deliver faster, more transparent, and fully compliant transactions while reducing settlement times and operational costs.

As Mexico’s payments ecosystem matures, the focus will shift from infrastructure to adoption: enhancing usability, security, interoperability, and inclusion for rural and underbanked communities. With a strong regulatory foundation and accelerating adoption, Mexico is on course to become one of Latin America’s most dynamic digital payment economies, and Thunes’ Global Network ensures that global businesses can be part of that growth story.

As innovation unfolds, regionally and globally oriented stakeholders should engage, integrate, and scale with Mexico’s payments transformation.

Looking to expand your global payments reach? Contact us to learn how our Network links international payment partners to local rails in Mexico and across Latin America, enabling fast, secure, and compliant money movement.