Wallet-First Economies: What They Mean for Cross-Border Payments

In many payment flows, the first place funds arrive is a digital wallet.

This could be a mobile wallet in an emerging market, embedded finance within a global platform or a value store within a nation’s dominant super app.

Wallets are playing a growing role in everyday payments, and their influence now extends to cross-border use cases, shaping expectations around how quickly and predictably international funds should arrive.

As wallet-first behaviour spreads, cross-border payment strategies built around traditional banking rails are under growing pressure to keep pace.

For global businesses, this shift is forcing a rethink of bank-centric cross-border models and accelerating the move toward wallet-native payment infrastructure.

Table of contents

What are wallet-first economies?

Wallet-first economies are markets where digital wallets play the primary role in how money is stored, moved, and accessed for everyday transactions.

Digital wallets take many forms, from pass-through wallets focused on authentication, like Apple Pay and Google Pay, to those able to store value, like Mercado Pago in Argentina and GCash in the Philippines.

The level of wallet reliance varies by market and maturity and reflects the range of wallet forms, whether that is as a secure location for payment details, simple value or token storage or highly capable financial platforms in their own right.

- In Europe and North America, wallets are regularly used for e-commerce payments, but storage is only beginning to be explored.

- In parts of Africa, Southeast Asia, and Latin America, mobile wallets are regularly used to send and receive funds, particularly for domestic transfers and everyday spending.

- In the Asia-Pacific region, super apps are combining wallets with commerce, transportation, and financial services, making wallets a primary interface for daily financial activity.

Wallet-first behaviour can have impacts across peer-to-peer transfers, merchant payments, refunds, gig payouts, and cross-border remittances. As wallets in some markets expand into support for lending, savings, and embedded financial services, their influence over everyday payments looks likely to grow.

Domestic real-time payment systems have also reshaped expectations around how quickly money should move. Wallets reinforce these expectations by delivering fast, intuitive payment experiences that integrate seamlessly into daily digital interactions.

Together, these dynamics are defining how users expect both domestic and cross-border payments to work.

How wallet adoption is changing cross-border payment expectations

As wallets become more integrated in daily financial activity, they are reshaping what users and businesses expect from international payments. Cross-border transactions are now being evaluated through the same lens as domestic wallet experiences.

1 Faster settlement is now the baseline

The speed of domestic payments has changed expectations for cross-border payments accordingly, particularly for people who rely on frequent payouts, such as gig economy workers and contract employees. Any friction caused by multi-day settlement cycles reduces the perceived value of digital payment experiences in wallet-led environments.

2 Local payment experiences drive trust and conversion

Wallet usage is closely tied to familiarity and local payment preferences. Payees want the option to have their cross-border payments delivered directly to a trusted local wallet; when this is unavailable, it harms the payment experience and reduces confidence in the transaction.

3 Real-time, predictable payouts are becoming standard

While speed is critical to the payment experience, users also expect clarity around delivery timelines, FX outcomes, and payment confirmation. Wallet-based cross-border payments need to provide reliable settlement and transparent pricing. Without this, they won’t align with these expectations and instead, increase the support overhead for the businesses.

Together, these shifts are raising the bar for how cross-border payment infrastructure needs to perform.

The limitations of bank-centric cross-border models

Many traditional cross-border payment models were designed around correspondent banking networks and batch-based processing. While these approaches continue to play an important role in the payment ecosystem, they are not suited to supporting wallet-based cross-border payments at scale.

In practice, payments routed through traditional financial institutions and bank-centric models introduce several structural limitations.

- Slower settlement timelines, driven by complex routing and cut-off times

- Limited transparency makes it difficult to track payment status and final delivery

- Indirect access to local wallet ecosystems, where payouts are routed through banks or third parties rather than connected directly to the wallet provider

- Lower financial inclusion, with many in the world’s population underbanked or unbanked

These limitations are becoming more pronounced as wallet adoption accelerates across both emerging and mature markets.

What this means for global businesses and payment providers

The rapid growth of digital wallets is a global trend, and Juniper has estimated that more than two-thirds of the world’s population is expected to own one by 2029.

In many emerging markets, mobile wallets are a primary or near-primary way for individuals and small businesses to receive funds. If a business can’t support local wallets, it adds friction to the local payment experience that can have a negative impact on adoption and conversion, frustrating partners and customers and diminishing trust in the business.

Supporting payouts to wallets is an obvious way to broaden market coverage and support financial inclusion through payment channels that are already widely used.

Businesses that can support wallet-native cross-border payments are best-placed to meet expectations around accessibility and transparency, while reducing reliance on fragmented local integrations. This creates a more consistent operating model across markets and lowers the effort required to expand internationally.

As wallets continue to play a larger role across regions, cross-border payment infrastructure needs to support them as a standard delivery method rather than a secondary option.

How Thunes supports wallet-native cross-border payments

As wallet adoption accelerates, businesses need a cross-border infrastructure that allows them to meet customers where they are.

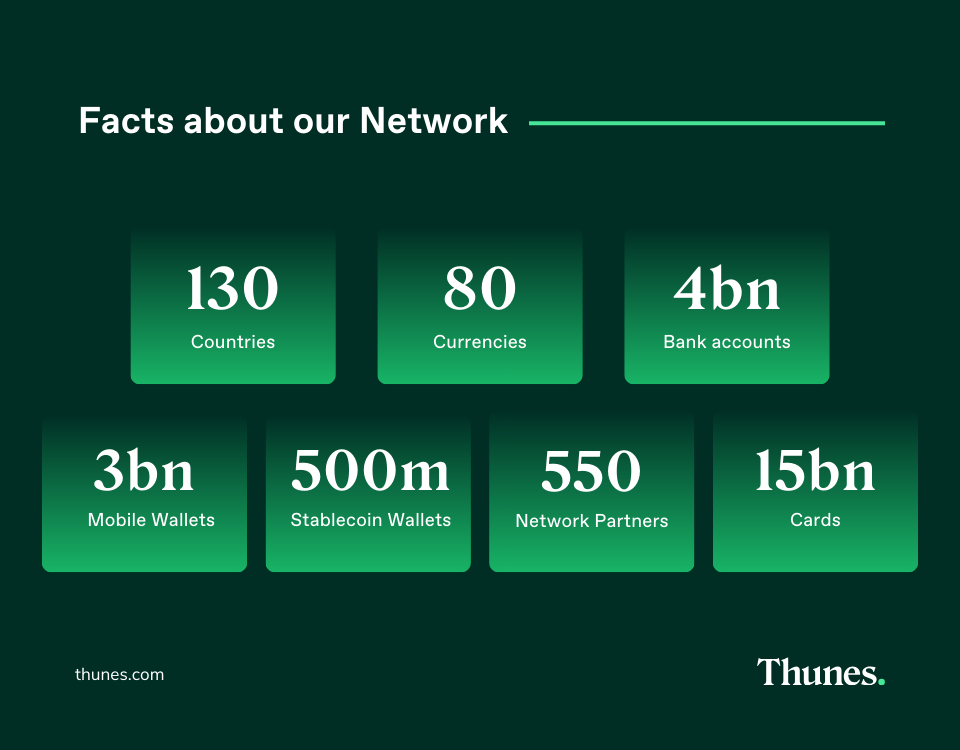

Thunes brings millions of wallets together with global network partners and offers access with a single integration. This unified approach is seamless for both the business and the end customer, and delivers four key advantages: reach, speed, compliance, and scale.

Reach local wallets globally through a single API

Thunes enables businesses to connect to its Direct Global Network via an API connection and reach digital wallets, stablecoin wallets, bank accounts and local payment methods across multiple markets.

Thunes reduces integration complexity and helps deliver consistent, wallet-native payment experiences across corridors. That means:

- Financial Institutions and Banks can extend their correspondent services via APIs or Swift messages.

- Financial institutions and PSPs can broaden their network and service coverage through a single integration.

- MTOs can expand corridors and reach and offer more diversified services (C2C / B2X).

Real-time and near-real-time wallet payouts

In supported markets, Thunes enables real-time and near-real-time delivery to digital wallets. These capabilities support time-sensitive use cases, such as gig-economy payouts, marketplace settlements, remittances, and refunds.

Built-in compliance and transparency

Wallet-native payments are underpinned by Thunes’ Fortress Compliance Platform, which embeds regulatory controls and monitoring at the Network level. With transparent FX and consolidated reporting, businesses have the visibility and control they need to scale wallet payouts.

Faster go-to-market times

Thunes connects businesses with the wallets consumers trust most, whether they are global or local brands, accelerating time-to-market and expanding global reach. When businesses can instantly connect with payment methods that are familiar and locally relevant, product launches can be faster and more seamless.

Future-ready cross-border payments

Wallet adoption will continue to expand as digital ecosystems mature and user expectations change. Businesses with cross-border payment strategies that reflect this shift are better equipped to support growth, resilience, and global reach.

By enabling payments to wallets via a single, scalable, truly global Network, businesses can deliver a relevant payment experience today while preparing for the next phase of cross-border commerce.

Contact us to explore how we support wallet-first cross-border payments through our Direct Global Network.