How to Manage Foreign Exchange Risk in Cross-Border Payments

Foreign exchange risk is not a trivial issue. Global corporations move around $23.5 trillion across borders every year and pay an estimated $120 billion in transaction fees, a large share of which comes from FX spreads and conversion costs.

Unmanaged FX risk adds unpredictable costs, slows settlements, and makes reconciliation harder. For businesses operating in multiple currencies or within emerging market payments, gaining control of FX exposure is no longer optional.

While these challenges are significant, the right approach and technology can turn FX from a pain point into a strategic advantage.

Table of contents

FX risk: The hidden cost of global payments

Every cross-border payment made in a foreign currency carries the risk that exchange rates could shift between when it’s initiated and when it settles. Even the smallest of fluctuations can erode profitability.

For businesses and platforms, unmanaged FX risk can cause:

- Margin erosion when rates move against you

- Settlement delays caused by mismatched payment amounts

- Operational inefficiencies from manual conversions and reconciliations

- Compliance risk in jurisdictions with strict currency controls

Managing these risks requires understanding where they come from and how they show up in day-to-day transactions. That starts with a closer look at the different types of foreign exchange risk businesses face.

What is foreign exchange risk in payments?

Foreign exchange risk is the possibility that the value of one currency will change relative to another between when a payment is initiated and when it is settled.

For businesses moving money globally, this exposure can appear in three main ways.

| FX risk type | What it means | Impact on business |

| Transaction risk | Currency value changes between invoicing and payment | Unexpected costs, margin erosion |

| Conversion risk | Opaque FX spreads and currency conversion fees | Lower profitability, inaccurate forecasting |

| Settlement risk | Delays or mismatches in multi-step payments | Reconciliation challenges, slower cash flow |

Let’s look at this through an example. Take a SaaS platform that bills a customer in USD, but receives payment in EUR. The service provider then needs to be paid in their local currency, such as PHP or NGN.

Each conversion can add 1–3% in hidden FX margins, meaning that by the time funds reach the end recipient, as much as 5% of the original value can be lost to spreads and fees.

Why is FX risk harder to manage in emerging markets?

FX risk exists everywhere, but it’s particularly challenging in emerging market payments for several reasons.

- High currency volatility: Emerging market currencies are prone to sharp, frequent fluctuations, making timing a critical factor in FX management.

- Wide gaps between official and market rates: In some markets, the official exchange rate can differ significantly from the rate available in the open market. This impacts the real value received.

- Limited access to hedging tools: Larger corporations may use sophisticated FX hedging instruments, but smaller businesses and platforms in emerging markets often lack access to these solutions.

- Inconsistent FX handling: Banks and payment intermediaries often handle FX conversions differently, with limited visibility for businesses.

- Opaque fees and spreads: Without upfront rate transparency, companies may face hidden costs that are only revealed after payment.

- Compliance and reporting complexity: Each market has its own reporting requirements and regulatory rules for cross-border transactions, adding to the administrative burden.

- Legacy infrastructure: Over-reliance on correspondent banks and outdated treasury systems slows settlement and increases exposure windows.

These challenges make it difficult to forecast costs or guarantee outcomes. That’s why many businesses are turning to new infrastructure designed for transparency and control that addresses FX risk at the source.

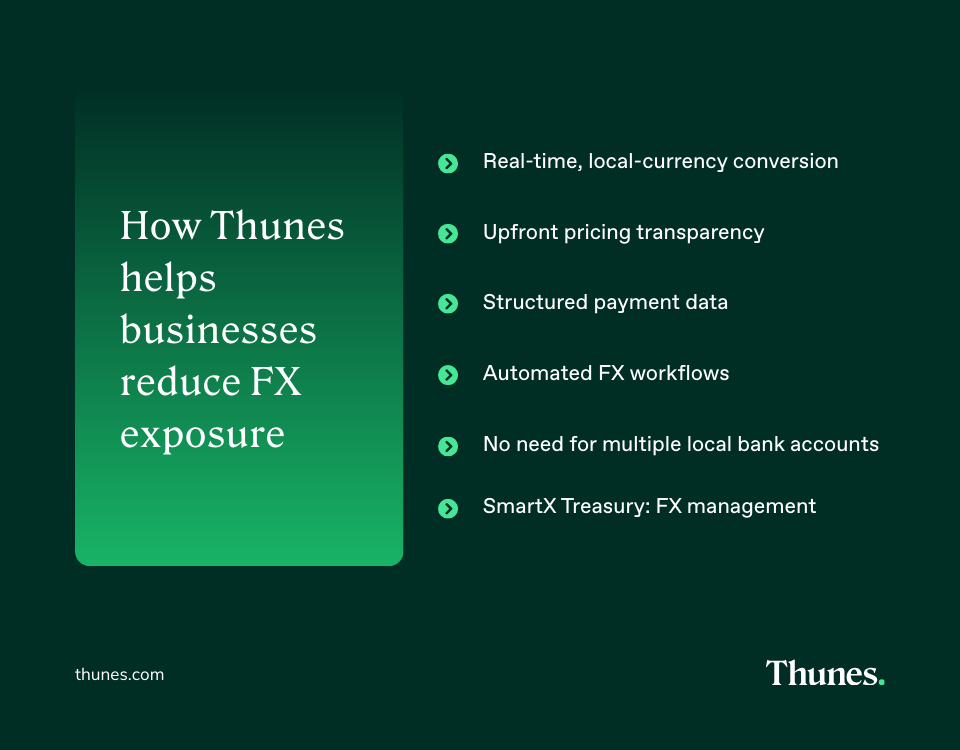

How Thunes helps businesses reduce FX exposure

Thunes delivers a global payment network and infrastructure built to address FX risk directly, particularly in high-growth and emerging markets.

Its capabilities give businesses greater control over rates, timing, and settlement, reducing exposure and improving operational efficiency.

Real-time, local-currency conversion

FX rates are locked in at the point of payout, ensuring that once a payment is confirmed, the recipient will receive the exact amount in their local currency. This removes uncertainty from rate fluctuations that can occur between payment initiation and settlement, protecting both sides from value loss.

Benefit: Locked-in rates help protect profitability and reduce unexpected costs.

Upfront pricing transparency

All FX margins and conversion rates are disclosed before the transaction is initiated. Businesses can see the exact cost of conversion and the amount the recipient will get, allowing for accurate forecasting, cleaner reconciliation, and better budgeting.

Benefit: Transparent pricing ensures you keep more of your margins and can plan cash flow with confidence.

Structured payment data

Every payment includes the relevant invoice and remittance information in a standardised format. This ensures funds are matched correctly to outstanding payments, eliminates manual lookups, and reduces reconciliation errors, particularly important when managing high payment volumes.

Benefit: Predictable FX conversions and clean data speed up reconciliation and financial closing.

Automated FX workflows

Thunes automates the process of converting and delivering funds across 130+ countries, removing the need for multiple manual steps or third-party coordination. Automation speeds up settlement, lowers operational overhead, and frees finance teams to focus on strategic work rather than administrative tasks.

Benefit: Less manual intervention means fewer errors, lower operational risk, and faster payments.

No need for multiple local bank accounts

With Thunes, businesses can fund payouts in one currency and have them delivered in the recipient’s local currency without opening or maintaining local accounts in every market. This cuts banking costs, reduces compliance complexity, and allows faster market entry.

Benefit: Simplifies cross-border expansion and reduces the administrative load on finance teams.

SmartX Treasury: Enhanced FX management

Thunes’ SmartX Treasury solution gives businesses added speed, transparency, and control over their cross-border flows. It brings together real-time settlement, upfront FX rates, and industry-leading payout success rates.

Benefit: Businesses gain greater visibility and efficiency in managing FX exposure through increased automation and optimisation.

Practical use cases: FX risk management in action

By using a solution like Thunes, businesses can take control of FX exposure, protect value, and simplify operations. The following examples show how this works in practice.

Paying suppliers across Southeast Asia

A manufacturing company sources components from Thailand, Vietnam, and Indonesia. Traditionally, they faced unpredictable FX margins and inconsistent delivery amounts due to multiple conversion steps.

With Thunes, the company pays suppliers in local currency at locked-in rates, ensuring predictable costs and faster reconciliation.

Payouts to gig workers in Africa

A global freelance platform pays contractors in Kenya, Nigeria, and South Africa. Bank wires often introduce delays, unexpected FX deductions, and compliance issues with local regulators.

Thunes enables instant payouts to bank accounts or mobile wallets in local currency, avoiding FX delays and ensuring gig workers get the full amount.

Multi-currency settlements for SaaS marketplaces

A SaaS marketplace charges customers in USD, EUR, and GBP, but needs to pay service providers in over 20 different currencies.

Instead of managing dozens of FX accounts and manual conversions, the platform uses Thunes to automate payouts with upfront FX transparency, turning settlement from a risk into a routine.

Move money without unnecessary risk

FX risk is a part of cross-border payments, but it doesn’t have to be unpredictable.

By identifying where exposure occurs and using the right infrastructure, businesses can protect margins, improve operational efficiency, and build trust with partners and customers.

If your business is expanding into emerging markets or scaling global payment operations, now is the time to review your FX strategy. A proactive approach means you can focus on growth, not on unpredictable exchange rates.

Thunes gives businesses and platforms the tools to make foreign exchange risk manageable. No intermediaries. No hidden fees. No endless delays. Just fast, transparent and reliable payments, at up to 10x cheaper than most bank transfers, across 130 countries and 80 currencies.

Contact us to explore how you can manage your FX risk.