Why real-time isn’t real yet for US cross-border payments

Real-time payments are quickly becoming the norm in U.S. banking. With RTP and FedNow, money now moves instantly, but only within national borders.

That speed stops at the border.

Despite progress on domestic infrastructure, 24/7 global settlement remains out of reach. When funds move internationally, “instant” often still means “next business day.”

Here, we explore why that gap persists, what’s needed to close it, and how Thunes is already delivering real-time, cross-border payouts for U.S. businesses.

Table of contents

What does ‘real-time payments’ really mean?

In payments, real-time refers to financial transactions that are cleared, confirmed, and settled in seconds, 24 hours a day, every day of the year.

Systems like the RTP Network, operated by The Clearing House, and FedNow, developed by the Federal Reserve, have introduced real-time clearing for U.S. domestic payments.

However, these systems are designed for the U.S. market only. Once a transaction leaves domestic rails, it enters a global network governed by different currencies, financial institutions, operating hours, and regulatory requirements. Each layer introduces friction and the chance of delay.

Consider a simple example: A U.S. freelance platform paying a developer in the Philippines on a Friday evening. The platform initiates an RTP transfer to its local bank partner instantly, but once the funds move offshore, the payment hits weekend cut-off times and intermediary bank queues. Despite an “instant” start, the developer may not receive funds until Monday or Tuesday.

Why U.S. cross-border payments still lag

The U.S. may have modernised its domestic payments ecosystem, but cross-border payments still rely on decades-old infrastructure.

The main barriers fall into four categories.

1. Legacy infrastructure

Traditional cross-border transactions move through correspondent banking chains and messaging queues. Each intermediary introduces latency, cost, and complexity into the reconciliation process. It’s far from the seamless experience of domestic instant payments.

The issue in action

A U.S. marketplace paying sellers in Nigeria must route funds through multiple correspondent banks. Each step adds fees and manual reconciliation, which can delay payouts by several business days. That results in slower seller onboarding and reduced platform trust.

2. Liquidity and FX bottlenecks

To guarantee fast settlement abroad, many businesses must pre-fund local currency accounts in destination markets. That ties up working capital and complicates treasury management. FX (Foreign Exchange) conversion adds further cost and uncertainty, particularly when rates move between initiation and settlement.

The issue in action

A U.S. payroll platform pre-funds EUR and GBP accounts to facilitate payments to contractors overseas. Capital sits idle each month waiting to be used, reducing liquidity for growth and creating exposure to volatile FX rates.

3. Regulatory and compliance friction

Cross-border payments trigger multiple screening layers as they pass through different banks, payment systems, and regulatory requirements. Sanctions checks, AML/KYC verification, and jurisdiction-specific reporting can pause transactions for hours or even days. The lack of real-time compliance orchestration makes it difficult to sustain speed at scale.

The issue in action

A U.S. fintech sends payouts to freelancers in Eastern Europe. Mid-flow, a receiving bank flags the transactions for manual review under local AML rules. Funds are frozen over the weekend, frustrating both the payers and recipients, despite initial “instant” processing.

4. Lack of interoperability

Domestic instant payment systems, like RTP and FedNow, don’t connect directly with global real-time networks such as PIX in Brazil or UPI in India. Without API-based interoperability between these domestic ecosystems, instant money movement stops the moment it crosses a border.

The issue in action

A U.S. retailer sends supplier payments to India using its bank’s RTP integration. The payment clears instantly within the U.S., then stalls once it hits traditional SWIFT rails. The supplier receives funds the next day, not in seconds, breaking the “real-time” experience for both parties.

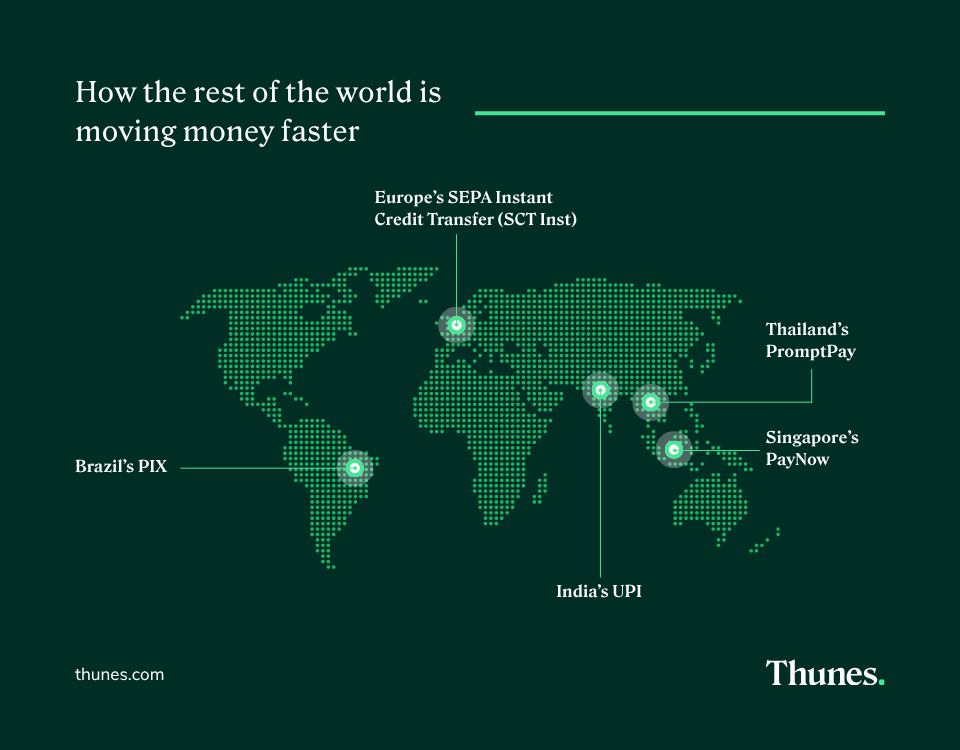

How is the rest of the world moving money faster?

The global standard for real-time is now set by networks that operate across borders.

- Brazil’s PIX enables 24/7 instant transfers and now serves over 160 million active users. It has become a model for interoperability between consumers, businesses, and government services.

India’s UPI processes billions of instant transactions each month and is expanding internationally through connections with Singapore’s PayNow, the UAE’s AANI, and others.- Singapore’s PayNow and Thailand’s PromptPay form part of the ASEAN network that already enables QR-based cross-border payments in seconds.

- Europe’s SEPA Instant Credit Transfer (SCT Inst) scheme operates in 36 countries and is to be mandated by 2025, allowing funds to move between European accounts in under 10 seconds.

These ecosystems are networked, API-first, and always-on. They demonstrate that with aligned standards, governance, and infrastructure, real-time can scale beyond borders, something the U.S. market has yet to achieve.

What’s needed instead is a global network that combines local access to instant payment systems, pre-positioned liquidity, and automated FX conversion and compliance.

Until those elements work in concert, cross-border rails will continue to lag behind.

How Thunes helps U.S. businesses go real-time

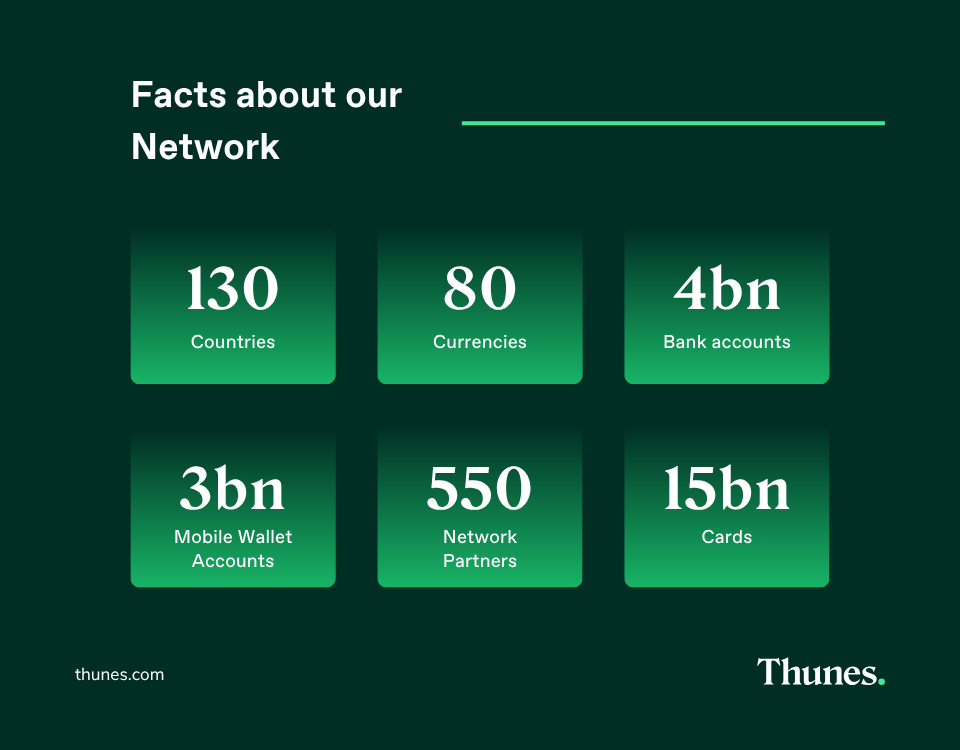

Thunes is closing the gap between domestic and global payment systems. Our Proprietary Direct Global Network enables U.S. institutions to deliver instant payment experiences across borders.

- One API for global instant payouts: Thunes connects to more than 7 billion mobile wallets, stablecoin wallets, bank accounts, and cards across 130+ countries, eliminating the need for businesses to establish correspondent banking relationships.

- Real-time settlement across fiat and digital rails: Through integrated access to local instant payment systems and stablecoin-based liquidity options, Thunes ensures funds move continuously across currencies, time zones, and markets.

- Fortress Compliance Platform: Every transaction is screened in real time for KYC, AML, and sanctions compliance. This built-in layer of protection means speed never compromises trust.

- Automated FX Management: Thunes’ SmartX Treasury System automates FX and payment execution, combining proprietary infrastructure, AI-driven forecasting, and built-in compliance to provide a scalable platform for global transactions.

- No pre-funding burden: Thunes eliminates the need to maintain idle balances in destination markets. Funds are delivered instantly without locking up working capital across corridors.

- Uptime advantage: Thunes’ always-on infrastructure moves money at any hour, on any day, including weekends and holidays, ensuring business operations never pause when borders or banks close.

With Thunes, borders are no longer barriers. A U.S. fintech can pay gig workers in Kenya to M-Pesa wallets in seconds. An e-commerce platform can settle instantly with sellers in Brazil via PIX. Both flows run through Thunes’ single API connection, powered by real-time connectivity and compliance that scales globally.

From instant domestic to instant global

The next frontier for U.S. cross-border payments is interoperability between FedNow, RTP, and other domestic rails to global instant networks. Achieving this requires coordinated liquidity management, API-driven compliance, and collaboration between banks, fintechs, and regulators.

Institutions that act now can leapfrog legacy models and deliver customer experiences that match or exceed those in faster-moving markets.

Thunes enables U.S. banks, fintechs, and enterprises to transform domestic real-time payments into global real-time money movement through a single API, a connected global network, and built-in compliance.

Discover how Thunes powers real-time payouts to over 130 countries.