Why MicroPayouts are Key to Gig and Creator Economy Growth and Profitability

The recent growth of freelancing work has led to a massive upheaval in the way we work. It’s no passing fad either – it’s proved to be a transformative trend in the global economy.

This shift in the work landscape has also demanded a shift in how payouts are made. With gig economy platforms serving a wider demographic of users and customers across the world, they are experiencing challenges in paying these users in their local currencies.

The key solution is micropayouts. Let’s explore this payment option in more detail and why using a Smart Superhighway like Thunes to move money around the world can help gig economy platforms, no matter the size of the payment.

Table of contents

The rise of the gig and creator economies: A transformative trend

In 2024, the gig economy had a market size of $556.7 billion. By 2032, that’s expected to more than triple to $1,847 billion.

Gen Zs and younger millennials are increasingly reliant on the gig economy as their sole or supplementary source of income. It’s estimated that around 1.57 billion people, or 47% of the global workforce, earn an income as freelancers, with close to 70% being 35 years old or younger. A host of creator economy platforms have thrived in serving this sector – think Fivver, Upwork, Uber and Airbnb – and we can expect many more to appear in the future as gig work increases in popularity.

The creator market growth is also geographically expansive. Africa is home to as many as 10% of the world’s global freelance workforce, while India and Pakistan rank amongst two of the world’s four most rapidly growing freelance markets.

On the service side of the gig economy sector, social media platforms have become digital workplaces for creators and content cultivators, expanding communities of fans and followers.

As creators amass followers, they monetise their content with donations, tips, partnerships, and other funding mechanisms within their chosen platform’s ecosystem.

Servicing the gig economy: Navigating payments

With the growth of gig, freelance and content creator segments, the focus on supporting this market has become important. To serve the freelancer community, platforms should address the ever-global and youthful creators and their need to make payments out of the platform.

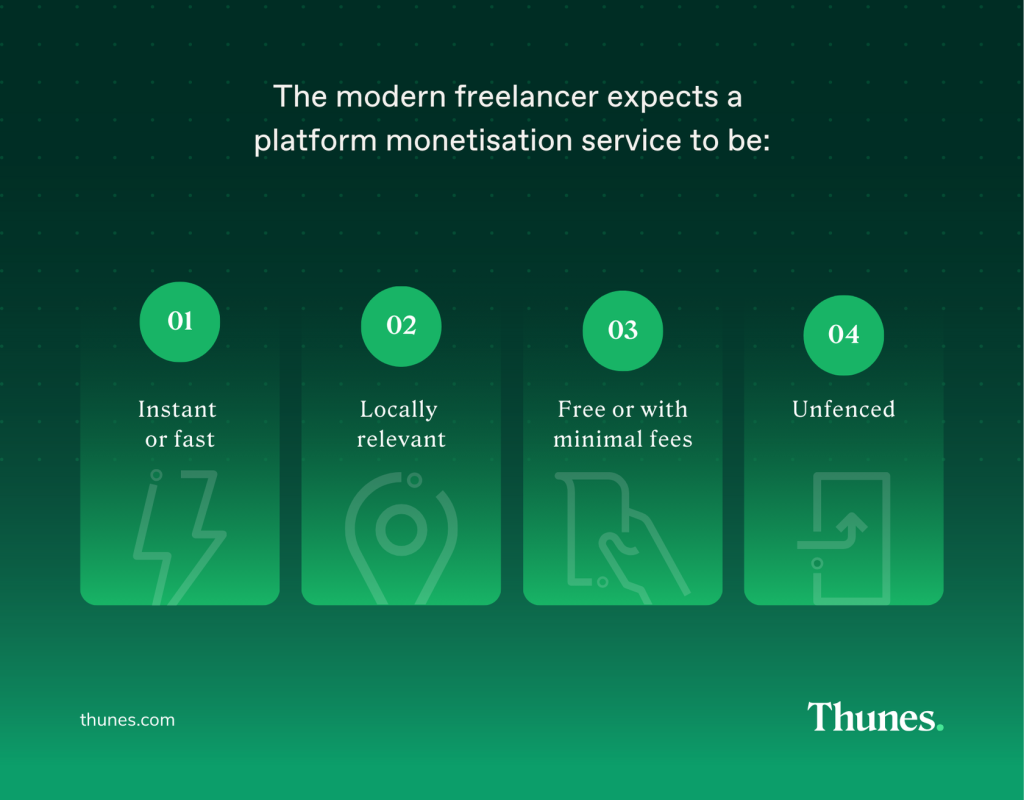

The modern freelancer expects a platform monetisation service to be:

- Instant or fast

- Locally relevant (available on locally popular payment methods)

- Free or with minimal fees

- “Unfenced” (available without having to accumulate a significant balance)

We’ll examine each of these elements in more detail, but on the whole, the answer to all these expectations is the ability of a platform to process micropayouts for global gig economy workers.

What are micropayouts?

Micropayouts are a subset of micropayments and specifically refer to small value payments made to individuals or businesses in their local currency, usually below US$10.

Making micropayouts run smoothly is the key to serving creators, freelancers, and gig economy workers.

Now, let’s define some of the key challenges in micropayments in the context of gig worker needs.

The key challenges of micropayouts

1. Recognising earnings reliably as creators accumulate

- The problem: Creator platforms tend to withhold cashout until their gig workers have earned over a certain threshold.

- The reason: Using legacy payment infrastructures, like banking rails and Swift, to pay creators comes at a fixed cost. These can be especially high when sending smaller value payments cross-border.

- The solution: Platforms need to use a micropayouts system that can price small-value, high-volume payments on an individual transaction level.

2. Giving freelancers options to get paid in the ways they want to be paid

- The problem: Platforms tend to offer bank account payouts, whether domestic ACH payments or international wires. For the creator or gig worker, this means additional fees and time to move money that is paid to a bank account to their preferred mobile or digital wallet.

- The reason: Legacy payment infrastructure platforms are often connected through banking rails, so they are limited to facilitating payouts to a bank account.

- The solution: A micropayout infrastructure provider must offer the ability to make payments beyond bank accounts and serve direct cash-outs to creators.

3. Providing the ability for gig workers to get paid with minimal fees

- The problem: FX conversion becomes a high-priced and long-timed endeavour when using traditional payment infrastructure. Moreover, creators lose transparency on the amount in local currency they will receive if the funds are sent from a dollar-based platform.

- The reason: Micropayout infrastructure previously didn’t offer the robustness of FX transparency and globally available payment services. Platforms were limited to the domestic market currency and without visibility into the destination amount received by a beneficiary.

- The solution: Platforms must select a micropayout provider that can simply and transparently convert currency and share the local currency value of a payout back to their gig worker.

How to select the best payment platform for mass micropayoutsf

There are many criteria for Payment Product teams to consider when selecting a mass payout platform that will facilitate payouts to gig economy workers:

- Coverage: The payment platform you choose should be able to process mass payouts in the currencies and payment methods your recipients prefer.

- Reliability and scale: The ability to process large volumes of small transactions for micropayouts at scale.

- Compliance with regulations: Compliance with local and international regulations.

- Security and fraud prevention: The platform should have robust AML screening for every microtransaction

- Flexibility: The ability to customise the micropayout solution to your specific business needs.

- Customer support: Look for a payment infrastructure platform that offers robust customer support with multiple channels for getting in touch. You should also check that customer support is available 24/7 to ensure that global issues or concerns can be addressed promptly.

- Pricing and fees: Consider the pricing and fees associated with the platform. Look for a payment platform that offers flexible pricing with no hidden fees and transaction costs that match your use case.

How Thunes can streamline operations and money flow

Freelance and creator platforms that don’t have an efficient micropayout function get pushed out to competitors, harm their reputation and, ultimately, lose their users. Gig worker platforms rely on the quality of their service to their community, and global payments are an important component of this service.

Selecting an infrastructure provider for micropayouts to cash out a freelancer requires close attention to the following:

- Speed: At Thunes, we have developed a reliable and scalable payment platform that can process high volumes of cross-border transactions in near real-time. All transactions are processed at the same speed, regardless of the volume of payments.

- Coverage: With a single API connection to our proprietary Direct Global Network, members can make payments in more than 130 countries in more than 80 currencies. The Thunes Network connects to over 7 billion mobile wallets and bank accounts worldwide.

- Transparency: Thunes offers users a detailed, transparent view of each transaction upfront, including FX and transaction fees. This allows gig and creator platforms to know the cost of sending money and exactly how much the beneficiary will receive in their local currency. Thunes’ transaction fee structure is flexible, enabling even cross-border transactions from as low as US$1 to be profitable.

- Regulatory compliance: Thunes offers automated data security and compliance solutions in global gig economy payouts. Our regulated network supports compliance standards worldwide, including the USA, the EU, and the UK.

With our Direct Global Network, Thunes delivers the highest quality of service and is a reliable partner to gig economy platforms because of our unparalleled global reach – our network facilitates reliable payments to over 7 billion mobile wallets and bank accounts and 15 billion cards. Thunes also acts as a single point of contact, which reduces the complexities involved in managing multiple relationships and accounts.

Because of this, Thunes is used by some of the top creator economy platforms and gig economy providers to process transactions with their freelancers around the world. By supporting partners with a flexible pricing structure and infrastructure, Thunes breaks down the barrier of limitations on thresholds and quality for micropayouts.

On top of reduced settlement times, on-demand cross-border transactions provide creators and freelancers with financial stability. Knowing that they can rely on your platform to provide them with a reliable source of income gives them the headspace to focus on what they do best: creating.

Ready to elevate your payment solutions? Connect to Thunes, the Smart Superhighway to move money around the world.