Nigeria: Building a cash-lite future

Nigeria is Africa’s largest economy, its most populous nation, and one of the continent’s fastest-growing fintech markets. With a population of over 238 million and a median age of just 18.1, the country offers both scale and untapped potential for payments innovation. Mobile penetration is increasing, ecommerce is expanding, and digital wallets are becoming everyday tools for millions.

Simultaneously, government efforts to modernise the financial system are driving rapid change. The Central Bank of Nigeria (CBN) is advocating for a cash-lite economy, where dependence on notes and coins gradually decreases in favour of digital channels that are quicker, safer, and more inclusive. The launch of the NIBSS Instant Payment (NIP) system has already established real-time transfers as the foundation of daily commerce, while new rules on open banking and remittances are transforming how money moves within and beyond Nigeria’s borders.

By building modern rails, empowering mobile-first solutions, and embracing policy reforms, Nigeria is laying the groundwork for a real-time, interoperable, and borderless payment ecosystem.

For fintechs, banks and corporates, the so what is clear: Nigeria is a key African market. Understanding how policy, infrastructure and consumer behaviour are evolving will be critical to shaping strategies, building partnerships and capturing growth in one of Africa’s most dynamic payment frontiers.

Government initiatives and regulatory push: laying the rails for a cash-lite economy

The Central Bank of Nigeria (CBN) has long recognised that an efficient and inclusive payments system is essential for growth. Over the past decade, it has implemented a series of policies aimed at digitising payments and increasing financial access.

The flagship initiative is its cashless policy, placing limits and fees on high-value cash withdrawals to discourage cash dependency. Combined with episodes of cash scarcity, these policies have nudged consumers and businesses to explore digital channels as more reliable alternatives.

Alongside behavioural nudges, the CBN has invested heavily in infrastructure. The NIP system, launched in 2011, has evolved into one of Africa’s most advanced real-time payment networks. It enables 24/7 interbank transfers that settle in seconds and has become the backbone for banks, fintechs, and mobile wallets alike. In 2024, NIP processed almost $703 billion in value, underscoring its deep integration into everyday life.

Policy innovation is also creating a more connected ecosystem. Open Banking guidelines, issued in 2023, provide the framework for secure data sharing between banks and fintechs, enabling new customer-centric products. Strengthened digital ID and Know Your Customer (KYC) systems further enhance trust, allowing more Nigerians to participate in the formal financial system.

The result is a payment landscape where regulation, infrastructure and innovation are moving in the same direction: reducing reliance on cash and unlocking more digital pathways for inclusion.

The rise of digital payments: from cash dominance to daily digital

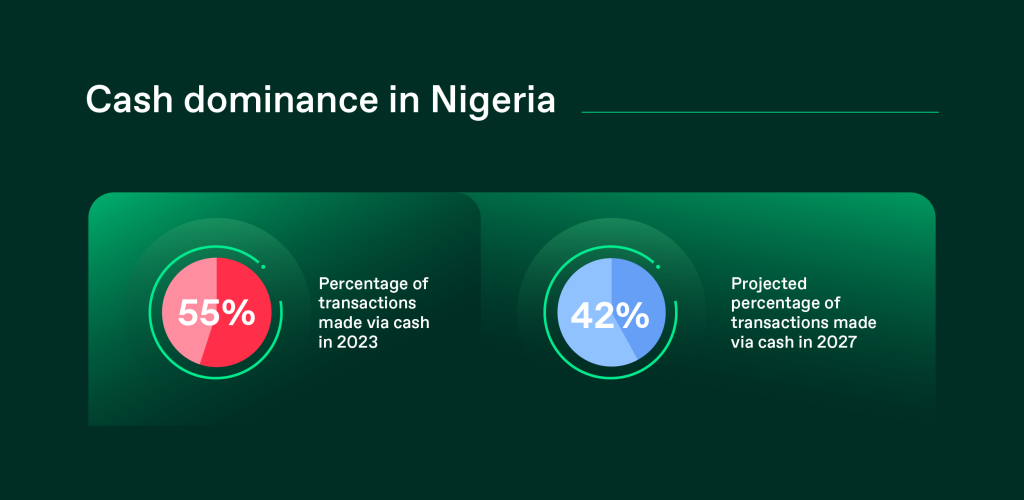

For decades, cash has dominated Nigeria’s economy, accounting for the vast majority of retail transactions. But the balance is shifting, with cash transactions dropping from 91% in 2019 to 55% in 2023, and projected to drop further to 42% by 2027.

This shift has been powered both by mobile innovation and the success of account-based instant transfers. The NIBSS Instant Payment (NIP) system has made bank transfers the preferred way to pay in Nigeria, from merchants to individuals. Today, consumers routinely complete purchases or bill payments by transferring directly to a merchant’s account, and even point-of-sale (POS) devices now support transfer-based payments alongside card transactions.

The COVID-19 pandemic further accelerated this behaviour, as consumers and businesses sought safer, contactless options. Combined with rapid smartphone penetration and regulatory nudges such as limits on ATM withdrawals and fees on large cash deposits, Nigerians have embraced bank transfers as a reliable, real-time alternative to cash.

Crucially, this digitisation has also laid the groundwork for mobile wallet adoption. The familiarity and trust built through real-time transfers have made consumers more comfortable with digital value storage, creating the behavioural bridge between bank-led digital payments and wallet-based ecosystems.

At the systemic level, Nigeria’s adoption of ISO 20022 payment messaging standards aligns it with global best practices. This will improve interoperability, enrich transaction data and make Nigerian payment rails more appealing for international connectivity.

Beyond payments, digital rails are now enabling a new wave of credit innovation. As more Nigerians build digital transaction histories through bank transfers and wallets, access to formal credit is expanding. The government is actively deepening the credit economy by supporting digital lending, mortgage access, and Buy Now, Pay Later (BNPL) schemes that are integrated with real-time payment infrastructure. These developments signal a shift from payment inclusion to credit inclusion, strengthening household resilience and unlocking new growth for businesses and consumers alike.

Remittances in Nigeria: lifeline flows becoming smarter

Nigeria is the largest recipient of remittances in Sub-Saharan Africa, with inflows exceeding $21 billion in 2024. These funds are vital for millions of households, supporting education, healthcare, and daily consumption.

Traditionally, remittances have been dominated by cash pick-up at banks or agents, often involving high fees and long wait times. That model is beginning to shift. The CBN has introduced reforms to align remittance pricing more closely with market rates, limit international money transfer operators (IMTOs) to inbound flows and encourage payouts in local currency. The goal is to bring more flows through formal channels while stabilising Nigeria’s foreign exchange market.

At the same time, technology is enabling faster and cheaper delivery. Digital-first remittance services are increasingly integrated with mobile wallets and bank accounts, reducing dependency on cash. In parallel, stablecoins and other digital assets are beginning to demonstrate their potential as efficient remittance rails, offering 24/7 settlement and lower costs compared to traditional correspondent banking.

Yet challenges remain. The persistence of ‘grey route payments’, informal channels that bypass official rails, continues to distort the market. Driven by FX shortages and the demand for lower-cost transfers, these routes lack transparency, expose users to fraud, and divert valuable foreign exchange away from Nigeria’s financial system.

For fintechs, banks, and corporates, this challenge also presents an opportunity: demand is steadily shifting toward trusted, compliant solutions that provide transparent pricing, guaranteed delivery, and secure settlement. Providers that can offer this reliability are well placed to capture growth and reinforce Nigeria’s broader journey toward a cash-lite, fully digital economy.

The introduction of the NRBVN platform, a joint initiative between the CBN and NIBSS, now allows Nigerians abroad to enroll their Bank Verification Numbers (BVN) remotely. This makes it easier for diaspora communities to access domestic rails and multi-currency accounts, further formalising inflows.

Together, these changes are turning remittances from a fragmented, cash-heavy process into a more efficient and transparent flow, one that supports both households and national liquidity.

Ecommerce and the digital economy: fuelled by payments

Nigeria’s ecommerce market is booming, driven by a young, digital-native population and rising internet penetration. From fashion to electronics to gaming, consumers are spending more online and payments are at the heart of this growth.

While cash-on-delivery once dominated online retail, trust in digital payments has grown rapidly. Instant bank transfers have become the preferred method for online purchases, supported by NIBSS Instant Payments (NIP), which enables fast and reliable settlement between buyers and merchants. Mobile wallets are also gaining traction, particularly for smaller, repeat purchases and subscriptions, while cards remain popular for higher-value ecommerce transactions.

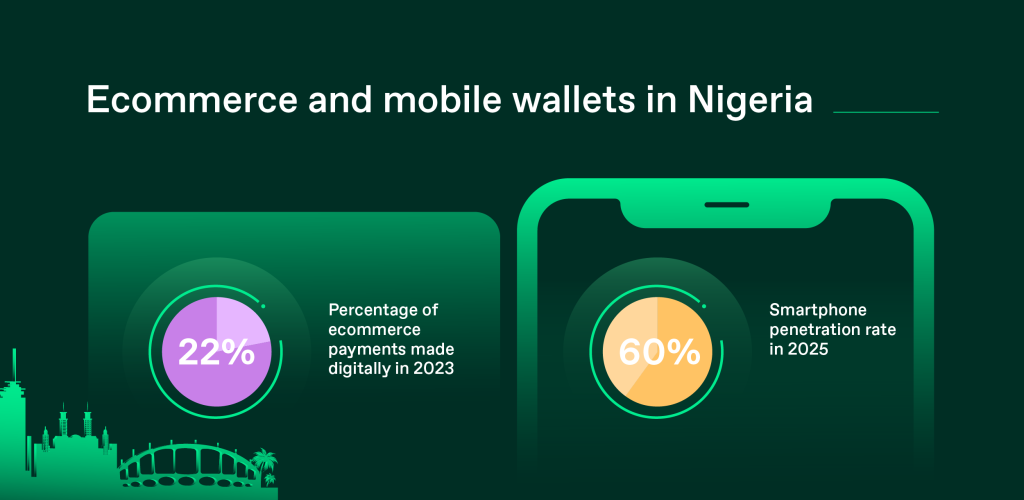

Together, these digital methods accounted for around 22% of all ecommerce payments in 2023, a figure expected to rise sharply as infrastructure, consumer trust, and merchant acceptance continue to expand. This shift reflects growing confidence in digital transactions and is enabling small businesses to reach more customers, streamline collections, and offer tailored checkout experiences.

The ecommerce ecosystem benefits from Nigeria’s payments innovation in two key ways. First, digital channels expand the customer base by reaching consumers who may not have traditional bank accounts but can transact via mobile wallets. Second, they create more efficient cash flow for merchants, enabling faster settlement and easier reconciliation.

As digital payments become the default option for ecommerce, they are helping to formalise economic activity and create a foundation for new sectors like subscription services, digital content and online education.

Mobile wallets: the frontline of digital inclusion

Mobile wallets are now one of the fastest-growing financial services in Nigeria, supported by rising smartphone adoption, reaching 60% in 2025, as well as widespread access through feature phones. Their expansion reflects the convergence of affordable devices, simple onboarding, and extensive agent networks that extend digital finance deep into underserved areas.

For many Nigerians, mobile wallets are a necessity. They provide a secure and accessible way to store money, send peer-to-peer transfers, pay bills and make everyday purchases. For gig workers and micro-entrepreneurs, wallets also serve as reliable payout channels, delivering funds instantly and creating transaction histories that can be leveraged for future services.

The potential of wallets goes beyond P2P and consumer payments. They are increasingly used for business-to-consumer disbursements, government transfers and utility payments. This versatility makes them a powerful tool for financial inclusion, especially in a country where formal bank penetration remains relatively low.

Unlocking cross-border opportunities with real-time payments

The growth of NIBSS Instant Payments demonstrates how central real-time infrastructure has become to Nigeria’s digital economy. By offering 24/7 settlement, NIP has reduced friction for consumers and businesses, becoming the default rail for account-based transactions.

The next opportunity lies in extending this real-time efficiency across borders. The Pan-African Payment and Settlement System (PAPSS) aims to create instant, low-cost settlement within the African Continental Free Trade Area. Connecting Nigeria’s NIP to PAPSS could accelerate intra-African trade by making payments faster, cheaper and more transparent.

At the same time, Nigeria faces challenges common to emerging markets: FX volatility, trapped liquidity and reliance on pre-funded accounts. Innovations such as stablecoins, real-time treasury tools, and smarter liquidity management systems offer potential solutions by freeing up capital and enabling 24/7 access to funds.

When successfully implemented, Nigeria has the potential to grow from a domestic leader in real-time payments to a regional hub for cross-border instant value exchange.

Be part of Nigeria’s cash-lite payments future

Nigeria is steadily moving towards a future where payments are instant and financial services are available to all. Government initiatives, real-time rails and mobile-first adoption are converging to transform the country’s payment landscape.

Remittances, ecommerce and mobile wallets are now becoming central pillars of economic growth and financial inclusion. The next phase will hinge on interoperability, liquidity and cross-border connectivity, ensuring that digital payments can scale seamlessly from local to global.

This is where Thunes’ Direct Global Network plays a vital role, connecting to more than 7 billion mobile wallets and bank accounts worldwide and supporting real-time payments across 130 countries. Members of the Network benefit from transparent pricing, efficient liquidity management and access to hundreds of local payment methods through a single integration.

For fintechs, banks, and businesses, this creates a foundation for inclusive growth, where every transaction, whether local or cross-border, moves with speed, security and certainty.

Nigeria is actively shaping the future of payments in Africa. By aligning domestic innovation with global connectivity, the country is poised to set the benchmark for the continent’s next decade of digital finance.

Looking to connect with Nigeria’s fast-evolving payment landscape? Contact us to learn how Thunes can help your business move money instantly, securely and globally.