Five Stablecoin Trends Shaping Global Payments in 2026

Stablecoins have moved beyond early experimentation.

Clearer regulation, stronger financial safeguards, and rising enterprise demand are bringing this digital asset into the mainstream of payments and treasury. What was once considered a speculative asset is becoming a practical tool for global liquidity, cross-border payments, and treasury optimisation.

2026 will mark a new phase. Stablecoins will become a usable, predictable rail for businesses that need speed, transparency, and control.

We’ve picked out some stablecoin trends we expect to have a big impact on payments in the months to come.

Table of contents

- 1. Stablecoin regulation makes the tech enterprise-ready

- 2. Tokenised liquidity reduces cross-border payment friction

- 3. USD stablecoins turn into instant settlement tools

- 4. Global platforms continue to adopt stablecoins

- 5. Stablecoin-to-local-rail connectivity

- How does Thunes help businesses leverage stablecoin payments?

- 2026 is the year stablecoins go to work

1. Stablecoin regulation makes the tech enterprise-ready

Regulation is the single biggest unlock for trust, adoption, and operational use at scale.

Over the past 18 months, policymakers and financial networks have made significant progress in defining the rules that govern issuance, reserves, and transparency.

- In the EU, Markets in Crypto-Assets (MiCA) is entering full implementation. It’s setting requirements for reserve composition and redemption rights, along with strengthened disclosure rules.

- Regulators in Singapore, Hong Kong, and the Gulf are strengthening reserve structures and audit frameworks.

- Central banks are advancing their own Central Bank Digital Currencies (CBDC), creating boundaries between public digital money and private stablecoins.

Behind the scenes, alignment is growing between regulated issuers, payment networks, and financial institutions, giving businesses greater clarity on how stablecoins fit into the traditional finance systems.

Stablecoins are starting to behave like cash equivalents, moving globally in seconds.

2. Tokenised liquidity reduces cross-border payment friction

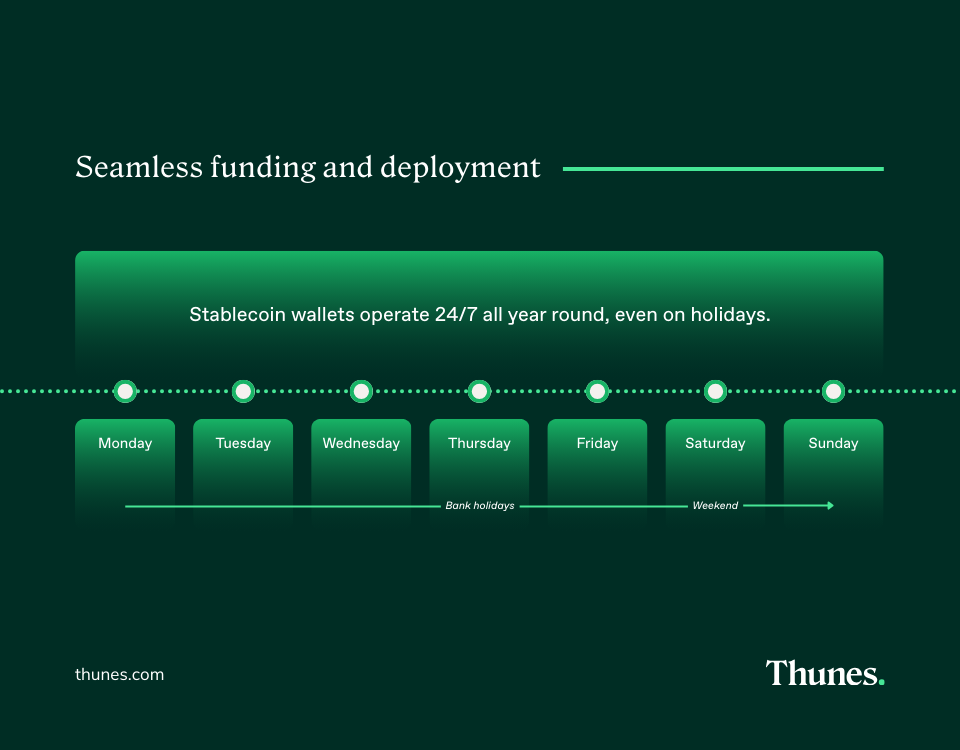

Tokenised liquidity sidesteps the slow, multi-layer paths of correspondent banking. Businesses no longer have to wait for reconciliation across multiple intermediaries. Instead, payments move on a unified ledger that operates 24/7.

This shift unlocks several operational benefits for businesses and platforms that make global payouts:

- Continuous settlement means liquidity can move globally at any moment.

- It removes the need to maintain cash buffers across multiple currencies to hedge against slow settlement times.

- Reduced foreign exchange (FX) exposure means conversions can occur closer to the moment of payout, improving cost control.

- Real-time payments and faster reconciliation improve forecasting and reduce idle capital.

The biggest competitive advantage is that treasury teams can access continuous liquidity mobility. With this, they can reduce buffer capital, strengthen cash-flow planning, and support more flexible global operations.

3. USD stablecoins turn into instant settlement tools

The US dollar remains the world’s dominant settlement currency. In 2026, we’ll see tokenised USD become one of the fastest ways to move money across borders, particularly for internal treasury flows and high-volume global platforms.

In practice, tokenised USD refers to USD-denominated stablecoins issued on blockchain networks, enabling near-instant settlement across borders.

On-chain USD volumes continue to accelerate as enterprises use stablecoins for intra-company transfers, intercompany loans, working capital positioning, and funding across global time zones. Because transfers settle in seconds, treasury teams can position liquidity closer to real-time, rather than waiting for the correspondent-bank cut-offs or batch windows associated with traditional banking systems.

Stablecoins are also reducing friction when funding into emerging markets. Tokenised USD can reach a local entity instantly, and FX conversion can then be executed locally or via integrated payout partners.

4. Global platforms continue to adopt stablecoins

Marketplaces, gig-economy platforms, gaming ecosystems, and creator networks are turning to stablecoins as a payout option, particularly where domestic payment systems introduce friction or volatility.

For example, a global freelance marketplace can use USD stablecoin payouts to serve workers in markets with volatile local currencies, such as Argentina or Nigeria, by paying talent in Tokenised USD.

It offers several other advantages:

- High-speed settlement to global users who want instant access to earnings.

- Improved predictability for freelancers, remote workers, and creators who often navigate slow or costly local rails.

- Alternative rails for volatile or high-cost corridors where traditional cross-border transfers through correspondent banking remain slow and costly.

- Access to Latin America, Africa, and Southeast Asia markets, where USD-denominated savings are commonplace.

5. Stablecoin-to-local-rail connectivity

Stablecoins are most useful when liquidity can move between on-chain value and off-chain payout rails.

In 2026, we’ll see stablecoins shift from being a parallel financial system to becoming a practical funding rail that enhances existing payment infrastructure.

That will transform how businesses can make payments:

- On-chain liquidity in, fiat out, to the user’s preferred local method.

- FX at the point of payout, giving treasury teams greater control over conversion timing.

- Integrated compliance, ensuring KYC and reporting obligations are managed within the workflow.

- Hybrid settlement flows that combine blockchain speed with accessible, local-currency usability.

How does Thunes help businesses leverage stablecoin payments?

Stablecoins offer speed and flexibility, but their full value is realised only when connected to reliable, real-time payout rails.

Thunes enables businesses to fund transactions in stablecoins or in fiat and pay recipients in fiat or stablecoins in 130+ countries through a single API.

A one-stop shop for payouts

Through our Direct Global Network, Thunes gives businesses access to over 7 billion mobile wallets and bank accounts, 15 billion cards and over 500 million stablecoin wallets around the world.

This one-stop shop for both stablecoin and fiat has several benefits:

- Instead of building local integrations market by market, businesses connect once and reach recipients across emerging markets in real time.

- Thunes’ customers manage a single liquidity pool for all payments (fiat and stablecoin payouts) rather than maintaining multiple pools with different partners.

Platforms and marketplaces can use stablecoins to fund operations while relying on Thunes for compliant, predictable last-mile delivery.

Stablecoin funding options

Thunes supports USDC as a funding source, allowing businesses to initiate payouts in stablecoins and convert within the payout workflow. This removes the need for multi-currency pre-funding across local bank accounts, reducing trapped capital and operational overhead.

The advantage for enterprises is that they can position liquidity on-chain and move it only when needed.

Transparent FX conversion

Businesses benefit from real-time FX conversion integrated directly into settlement flows. Thunes enables conversion at the exact moment of payout, giving businesses tighter control over cost, timing, and exposure.

Rates are transparent and predictable, helping finance teams reconcile faster and manage volatility across emerging markets.

Built-in compliance at every stage

Compliance remains a critical requirement as stablecoin adoption increases. Thunes’ Fortress Compliance Platform provides transaction monitoring, sanctions screening, and local regulatory support across dozens of markets.

By embedding compliance at every stage of the payout flow, our platform helps businesses scale the use of stablecoins while maintaining the controls expected by regulators and financial partners.

2026 is the year stablecoins go to work

Stablecoins are becoming a practical tool for moving liquidity across borders, faster and under tighter control.

In 2026, leading enterprises will use stablecoin funding alongside global payout networks to reach users, optimise treasury, and scale into new markets with less friction.

Thunes connects on-chain liquidity to 130+ countries through a single API, with real-time FX, local delivery, and built-in compliance.

Talk to Thunes about turning stablecoins into a core part of your global payout strategy.